ny paid family leave tax code

Your premium contributions will be reported to you by your employer on Form. The maximum employee contribution in 2018 shall.

State Rankings On Economic Well Being For Children 2013 From The 2013 Kids Count Data Book From The Annie E Casey Foun Counting For Kids Kids Health Health

EMPLOYEE CONTRIBUTION Employers may collect the cost of Paid Family Leave through payroll deductions.

. An employee must work at least 1250 hours in the 12 months before FMLA leave. For 2022 the SAWW is 159457 which means the maximum weekly benefit is 106836. Employees taking Paid Family Leave receive 67 of their average weekly wage up to a cap of 67 of the current Statewide Average Weekly Wage SAWW.

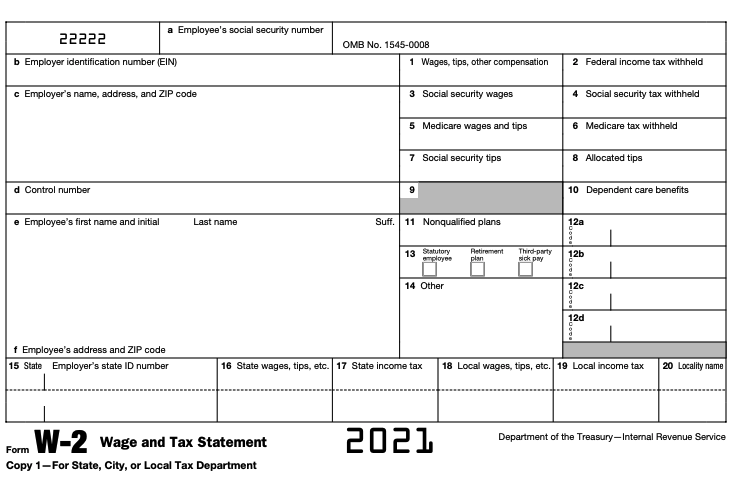

Employers may offer employees the. Use Paid Family Leave. On this years New York State W-2 in Box 14 there is NYPFL which is for New York Paid Family Leave.

The New York State Department of Taxation and Finance Department recently released its guidance on the tax implications. The current tax rate. The contribution amount is 0126 of the employees average weekly wage and capped at the New York Average Weekly Wage AWW which is currently 130592.

Now after further review the New York Department of Taxation and. What category description should I choose for this box 14 entry. This is an employee-only paid tax and employees can be exempt from this tax.

September 8 2017 by Hinshaw Culbertson LLP. 67 of the employees average weekly wage or 67 of the statewide average weekly wage whichever is less. Prior to creating this tax go to New York State Paid Family Leave to verify the following.

The maximum annual contribution is 42371. This is 9675 more than the maximum weekly benefit for 2021. W A Harriman Campus Albany NY 12227 wwwtaxnygov N-17-12 Important Notice August 2017 New York States New Paid Family Leave Program The States new Paid Family Leave program.

The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. New York Paid Family Leave requires an employee to work 26 weeks before taking leave.

New York Paid Family Leave is insurance that is funded by employees through payroll deductions. In 2022 the employee contribution is 0511 of an employees gross wages each pay period. Vacation and Personal Leave.

Each year the Department of Financial Services sets the employee contribution rate to match the cost of coverage.

Moneyvalue Creating Generational Wealth Life Insurance Quotes Term Life Insurance Quotes Wealth

1099 G Tax Form Why It S Important

On This Year S New York State W 2 In Box 14 There Is Nypfl And Nydbl What Category Description Should I Choose For These Box 14 Entries

Pin On From Spinoza To Einstein And More

New York Paid Family Leave Updates For 2022 Paid Family Leave

What Is Fica Tax Contribution Rates Examples

The Most Common Tax Mistakes Infographic Income Tax Income Tax Return Tax Consulting

Inspirational Travel Quotes For Every Kind Of Adventure Travel Quotes Inspirational Best Travel Quotes Funny Travel Quotes

Hr Management Report Template Unique 1300 Resume Examples Awesome Images Sample Resume Cover Letter Manager Resume Resume Writer Resume

Cost And Deductions Paid Family Leave

Explore Our Example Of Letter Of Explanation For Deposit Template For Free Letter Templates Letter Example Lettering

The Restaurant Of The Future Creating The Next Generation Customer Experience Restaurant Trends Guest Experience Restaurant

Education Cost Split By State Higher Education Public University Education

W 9 Form What Is It And How Do You Fill It Out Smartasset Fillable Forms Blank Form Tax Forms

Stay At Night Hotel Times Square In New York Ny Dates Into August Nyc Landmarks Times Square Famous Addresses